Prospects store at a Walmart in Houston on Aug. 4, 2021.

Brandon Bell | Getty Photos

After a year-long dip, family money circulation will start rising once more proper after Christmas, and speed up via the brand new 12 months, in response to new analysis by analysts at Goldman Sachs.

These positive aspects will reverse a 12 months of unfavorable progress of about $600, or 4.2%, in family discretionary money circulation, in response to Goldman’s evaluation.

“This 12 months, we’re taking a look at unfavorable discretionary money circulation for the primary time for the reason that 2008-09 monetary disaster,” Goldman client items analyst Jason English stated on a current webinar with the press. The most important driver of the money circulation enchancment subsequent 12 months, he stated, will probably be wages.

That is excellent news for retail gross sales after a yearlong wrestle to maintain up with inflation, and for the economic system’s means to keep away from a recession, in response to Mark Zandi, chief economist at Moody’s Analytics, which has an analogous forecast of enhancing client funds.

“Money circulation obtained hit throughout 2022 nevertheless it’s coming again, and money circulation is what drives spending,” Zandi stated. “Companies are unlikely to chop jobs as a result of they know their largest downside is discovering staff,” Zandi added.

The hyperlink between client money circulation and retail

Whereas a lot has been product of the patron resilience throughout a interval of slowing financial progress, the market has punished retail corporations, which have declined roughly twice as a lot because the broader U.S. inventory market index this 12 months, measured by the relative efficiency of the SPDR S&P Retail ETF and S&P 500 Index. This 12 months’s sloppy efficiency in client spending is occurring as a result of households have much less money coming in — despite the fact that they’ve extra financial savings — since stimulus funds designed to struggle the Covid pandemic led to 2021.

Retail gross sales within the U.S. have risen about 10% within the final 12 months, however most of that displays the surging greenback worth of gasoline and different items offered at this 12 months’s inflated costs, in response to current Commerce Division knowledge. Auto gross sales have risen simply 1.5 %, far beneath the tempo of inflation. That has helped the tempo of inflation-adjusted client spending progress sluggish to about 1.5 % within the first half of 2022, in contrast with almost 12 % a 12 months earlier.

The surge in capital items spending through the transient Covid recession, as customers snapped up furnishings and different home-related items after they spent extra time at dwelling because of the pandemic, contributed to retail’s stoop this 12 months as a result of it pulled demand ahead, English stated.

However the flip is coming, in response to Goldman.

The drop in client money circulation started as a steep one, however the unfold between 2021 and 2022 has been steadily narrowing. Within the first quarter, customers had 10% much less discretionary money obtainable than in the identical month a 12 months earlier, which Goldman says will slender to a 2.7 % dip this quarter and a 1.2 % drop for the vacation season.

The money circulation measure Goldman makes use of provides different sources of money, like authorities switch funds and borrowing, to present revenue, and subtracts important bills like meals and gas, giving a fuller image of customers’ probably means and willingness to spend.

Subsequent 12 months, the numbers get extra constructive via the 12 months, Goldman’s estimates present. Client money circulation will rise by 2 % within the first quarter, and rise to six percent-plus within the second half of 2023, an total acquire of about $600 billion.

Huge field retailers could profit essentially the most

Whereas the upswing in client revenue is nice information for the economic system, it might not profit all corporations equally, in response to CFRA Analysis analyst Arun Sundaram, who expects the acquire in client revenue will assist large retailers essentially the most. Giant-scale gamers like Amazon and Walmart, and to a lesser diploma Goal, will probably be winners and take market share, he stated.

The sluggish retail circumstances of this 12 months could maintain smaller client corporations from getting access to capital markets which have gotten extra selective at the same time as circumstances enhance. “They need to have raised cash a 12 months in the past,” Sundaram stated. “Now markets are tighter … They’re attempting to chop bills and cut back their money burn.”

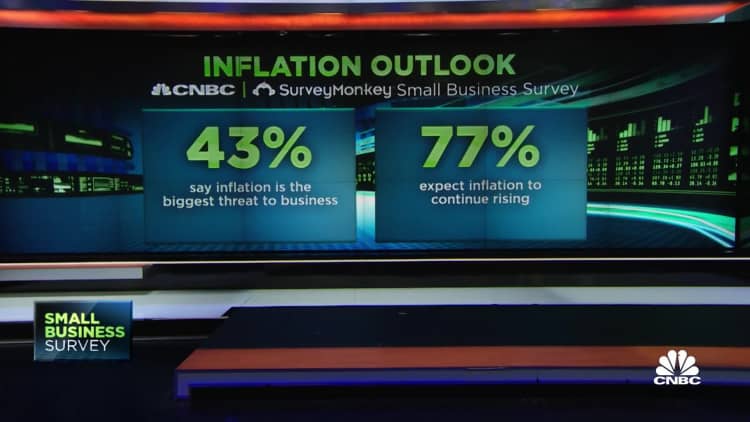

Whereas Sundaram was specializing in client startups that went public lately, similar to Oatly and Past Meat, the temper amongst America’s broader small enterprise group isn’t optimistic, with inflation persevering with to harm Important Road’s means to take care of margins at a time of upper costs in inputs, from uncooked supplies to power, transportation and labor. Most small enterprise house owners imagine a recession is inevitable; in truth, some assume the recession has already begun and have lowered their gross sales outlook into the following 12 months, in response to the most recent CNBC|SurveyMonkey Small Enterprise Survey for Q3 2022, which noticed small enterprise confidence hit an all-time low.

In the meantime, the world’s largest retailer Walmart — which had lowered second-quarter revenue targets however then reported a beat on August 16, devoted a lot of its second-quarter earnings name to explaining its funding plans — which chief monetary officer John David Rainey stated will probably be one supply of the chain’s hopes to spice up profitability within the 12 months forward.

Walmart has boosted capital spending 50% to $7.5 billion within the first half of its fiscal 12 months, which ends in January. Rival Goal, which skilled a 90 % drop in second quarter earnings, almost doubled funding, to $2.52 billion from $1.34 billion. Walmart CFO John Rainey cited the buildout of automation and expertise all through its enterprise, and the way it will proceed to assist drive larger effectivity, in a name with analysts after its earnings. He pointed to the corporate’s augmented-reality Viz Decide expertise, which makes use of staff’ cell telephones to hurry up restocking of cabinets to keep away from misplaced gross sales.

Earlier than the approaching pop in buyer revenue, retailers nonetheless should get via the again to highschool and vacation buying seasons, when family revenue will nonetheless be somewhat decrease than it was in 2021 and retailers will nonetheless be coping with extra stock of home-related items that they’ve been marking down and writing off.

“If we’re cleared by the vacations, we’re in a lot better form going ahead than the market is at present estimating,” English stated.

Related posts

Subscribe

* You will receive the latest news and updates!

Quick Cook!

Is it Unlawful to Demand a Return to Workplace?

The patterns of distant and versatile working that adopted the COVID-19 pandemic and lockdown restrictions are starting to waver, with…

The Startup Journal The way to Safe Short-term Startup Funding If You Don’t Have Traders But

Beginning a brand new enterprise is an thrilling journey, but it surely usually requires a big sum of money to…