Synthetic intelligence has prompted quite a few business leaders to reassess their priorities and shift their investments into this sector. Amazon (NASDAQ: AMZN) seems keen to determine a big presence, evidenced by its choice to inject an extra $2.75 billion into an Antrophic startup, marking its largest funding in three many years.

This transfer follows an preliminary funding of $1.25 billion introduced in September, with Amazon initially committing to take a position as much as $4 billion. The current information on March 27 signifies Amazon’s second installment of funding towards this initiative.

Why did Amazon decide Antrophic for its funding?

The announcement of Amazon’s funding comes shortly after Anthropic unveiled Claude 3, its newest suite of AI fashions touted as its quickest and strongest up to now. In response to the corporate, its most superior mannequin surpassed business benchmarks, outperforming rivals like OpenAI’s GPT-4 and Google’s Gemini Extremely in areas equivalent to undergraduate-level information, graduate-level reasoning, and primary arithmetic.

Amazon’s funding in Anthropic will end result within the e-commerce large holding a minority stake within the firm with out securing a seat on Anthropic’s board. The settlement was finalized based mostly on Anthropic’s most up-to-date valuation, which stood at $18.4 billion.

The partnership is mutually helpful. Anthropic has agreed to make the most of AWS as its main cloud supplier as a part of the deal. Moreover, it’ll leverage Amazon chips for coaching, growth, and deployment of its foundational fashions. Amazon has been investing in its chip designs, probably positioning itself for competitors with Nvidia (NASDAQ: NVDA) sooner or later.

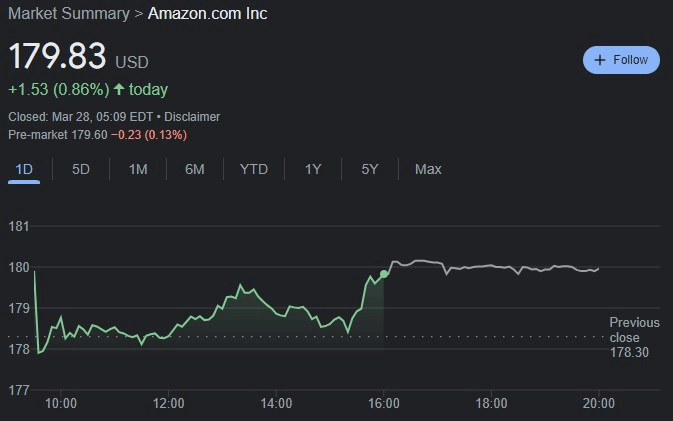

Amazon inventory value chart

The announcement of the funding didn’t seem to considerably affect Amazon’s inventory value, with a mere 0.13% loss in pre-market buying and selling. This left its closing value of $179.83 largely unaffected, regardless of having skilled day by day positive aspects of 0.86% prior to now 5 buying and selling periods, which had been marred by a slight lower of -0.07%.

Yr-to-date, AMZN inventory has elevated by 19.94% in worth.

The information of the funding hasn’t been nicely obtained by regulatory our bodies, that are intensifying their antitrust efforts. These efforts have already focused Apple (NASDAQ: AAPL) and will lengthen to different business giants suspected of participating in ’spherical tripping’—an criminality used to channel funds again into their departments, thus bolstering their funds.

Purchase shares now with eToro – trusted and superior funding platform

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.

Related posts

Subscribe

* You will receive the latest news and updates!

Quick Cook!

Is it Unlawful to Demand a Return to Workplace?

The patterns of distant and versatile working that adopted the COVID-19 pandemic and lockdown restrictions are starting to waver, with…

The Startup Journal The way to Safe Short-term Startup Funding If You Don’t Have Traders But

Beginning a brand new enterprise is an thrilling journey, but it surely usually requires a big sum of money to…