Typically, there’s a skinny line between choosing a promising tech start-up inventory with the potential to reshape the market and a unusual firm promoting glittery mud. It may be extremely tough to maintain religion in a product with a nonetheless non-existent market—nearly as complicated as creating a brand new market from scratch. In spite of everything, numerous tech start-ups sank as traders deserted ship and their merchandise by no means noticed the sunshine of day.

This might have been the story of this firm, as mere days separated it from chapter, not as soon as however twice. At the moment, that tech start-up inventory is likely one of the most acknowledged names within the tech trade. At the moment’s final comeback story is Tesla (NASDAQ: TSLA).

The near-fatal Christmas Eve of 2008

You may not be acquainted with the truth that December 2008 may have been the tip for Tesla. Christmas Eve would have been the day the corporate ran out of cash to cowl the funds, and three days later, it must file for chapter.

An important investor, VantagePoint Capital, led by Alan Salzman, resisted Tesla’s lifeline bid to boost $20 million and maintain the corporate afloat as a result of strategic route of the corporate. Allegedly, Salzman needed to shift Tesla in the direction of supplying batteries to conventional automobile producers and quit on electrical automobiles like different main automobile trade gamers.

Elon Musk fiercely opposed this, however Salzman had the facility to veto the essential funding spherical. On the final second, a gathering with a restructured financing plan was scheduled. Finally, the settlement was reached, and the corporate missed its demise by a thread.

That funding spherical accomplished 6pm on Christmas Eve in 2008. Final hour of final day doable, as traders have been leaving city that evening & we have been 3 days away from chapter. I put in all cash I had, didn’t personal a home & needed to borrow cash from pals to pay lease. Tough time.

— Elon Musk (@elonmusk) November 3, 2020

Musk later said that, had issues gone the opposite method round, Tesla could be lifeless, and all the electrical automobile trade wouldn’t have taken off for a few years as carmakers worldwide discontinued their EV efforts.

The “manufacturing hell” of mid-2017 to mid-2019

December 2008 wouldn’t be Tesla’s final monetary wrestle; based on Musk himself, the interval between mid-2017 and mid-2019 was additionally tough for the corporate.

Closest we received was a few month. The Mannequin 3 ramp was excessive stress & ache for a very long time — from mid 2017 to mid 2019. Manufacturing & logistics hell.

— Elon Musk (@elonmusk) November 3, 2020

Tesla went by means of a money crunch as mounting losses accompanied manufacturing targets for its Mannequin 3 sedan. In contrast to its earlier luxurious automobile fashions, the Mannequin 3 was cheaper, and the corporate had an enormous variety of pre-orders. In an effort to hit their manufacturing targets sooner and optimize the manufacturing course of, Tesla put important assets into robotics and automation. Nonetheless, the transfer backfired as manufacturing encountered huge delays.

The corporate ended up dangerously near chapter—once more. On August 8, 2018, Elon Musk tweeted that he was contemplating turning Tesla into a personal firm. Subsequently, he confronted a number of lawsuits, together with a securities fraud cost from the SEC, which pressured him to resign as the corporate’s chairman.

By the tip of that 12 months, Tesla had solved the manufacturing points, and the Mannequin 3 was the world’s most offered electrical automobile till 2021.

Tesla at the moment

Based in 2003 and headquartered in Austin, Texas, Tesla is a tech big using over 140,000 folks worldwide. It’s among the many world’s most respected firms, boasts a worldwide acknowledged model, and stays inside the high ten firms by index weight within the S&P 500.

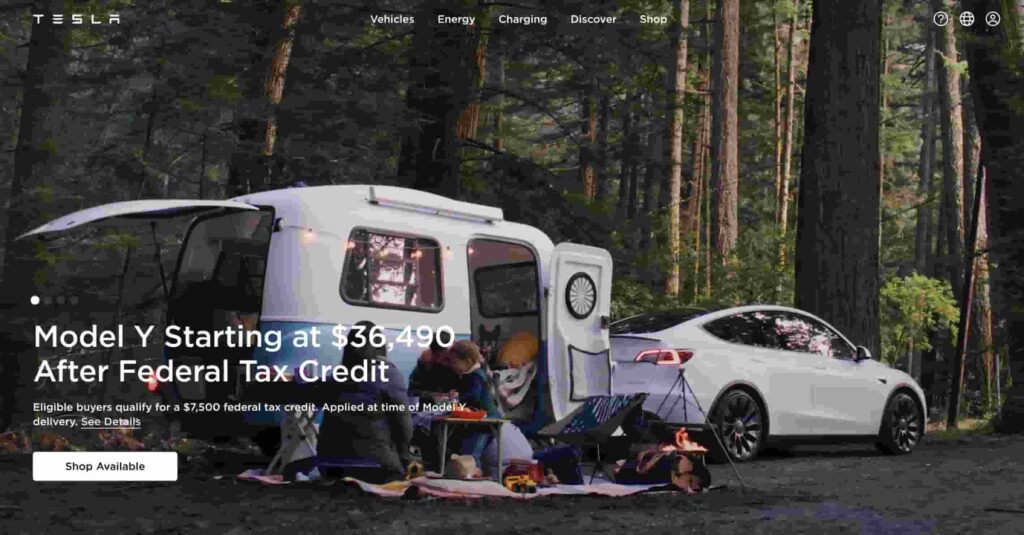

Tesla has disrupted the automotive trade with electrical vehicles just like the Roadster, Fashions S, 3, X, Y, and the Tesla Semi truck. The corporate can be spearheading sustainable vitality, and it has made strides in the direction of synthetic basic intelligence (AGI) with initiatives like Optimus.

Elon Musk, the CEO, co-founder, and former chairman of Tesla is the world’s richest particular person and among the many most controversial. Even with out “the Musk impact,” Tesla has a worldwide affect in the marketplace and can seemingly stay a vital vector in the way forward for commerce.

Tesla inventory is a part of the Nasdaq-100, S&P 100, and S&P 500 indices. It trades on the NASDAQ underneath the TSLA ticker image.

The underside line

Though it could be exhausting to think about Tesla as a tech start-up nearing chapter, it occurred twice. If it occurred to Tesla, it may occur to any firm. Subsequent time you decide a penny inventory claiming disruptive market potential, do the analysis twice: you may surrender on a penny and miss a fortune!

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.

Related posts

Subscribe

* You will receive the latest news and updates!

Quick Cook!

Is it Unlawful to Demand a Return to Workplace?

The patterns of distant and versatile working that adopted the COVID-19 pandemic and lockdown restrictions are starting to waver, with…

The Startup Journal The way to Safe Short-term Startup Funding If You Don’t Have Traders But

Beginning a brand new enterprise is an thrilling journey, but it surely usually requires a big sum of money to…