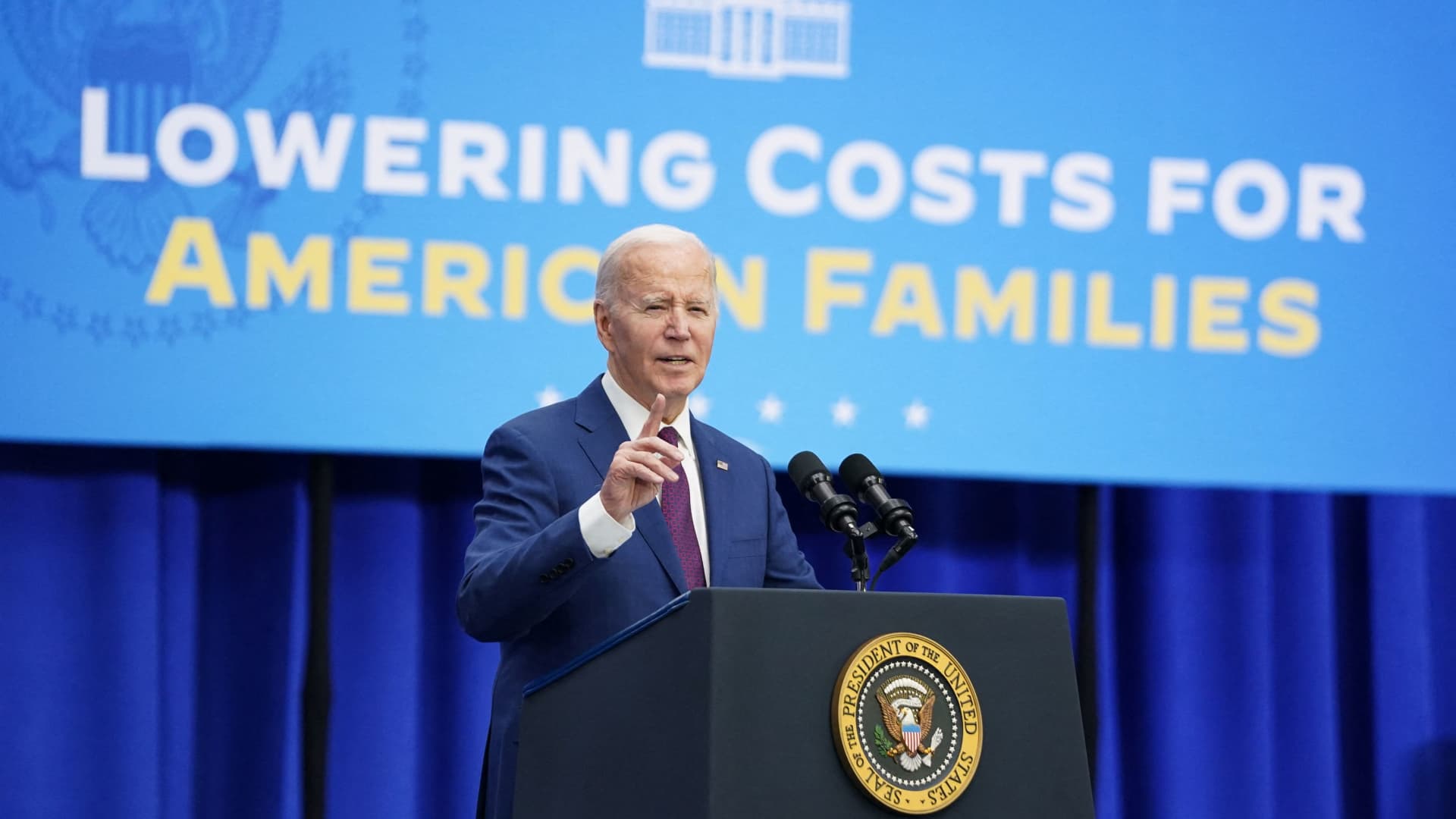

U.S. President Joe Biden delivers remarks on decreasing prices for American households throughout a go to to Goffstown, New Hampshire, U.S., March 11, 2024.

Kevin Lamarque | Reuters

The combat in opposition to inflation was going effectively for the Federal Reserve and financial system for a lot of final 12 months and into 2024, however one essential demographic remained unconvinced concerning the progress being made in decreasing pricing: small enterprise house owners.

Now, extra influential events are coming round to a view that small companies have been cussed in saying is nearer to the on-the-ground fact: inflation is not coming down quick sufficient. On Wednesday, Federal Reserve Chair Jerome Powell conceded that after three months of disappointing information on inflation, there was a “lack of additional progress” this 12 months. Market merchants, who not way back had been in rate of interest reduce euphoria mode and forecasting as much as six price cuts by the Fed this 12 months, are actually extra more likely to see one or two cuts at most.

Disappointment over inflation is nothing new for small enterprise house owners, and their frustration over excessive costs is growing once more, in accordance with the CNBC|SurveyMonkey Small Enterprise Survey for Q2 2024.

One in 4 (24%) small enterprise house owners inform CNBC that they assume inflation has reached a peak, down from 29% within the earlier quarter, and again to the place the financial sentiment studying was a 12 months in the past. The share of small enterprise house owners who count on inflation to rise from right here is trending up as effectively — 75% this quarter, up from 69% in Q1.

“Small enterprise house owners are the engine of our financial system, and the information exhibits they’re nonetheless pessimistic about overcoming inflation,” Lara Belonogoff, senior director of brand name administration and analysis at SurveyMonkey, stated in a press release upon the Q2 survey’s launch.

This CNBC|SurveyMonkey on-line ballot was carried out April 8-12, 2024 amongst a nationwide pattern of two,130 self-identified small enterprise house owners ages 18 and up.

Regardless of a constructive market response to Fed Chair Powell’s feedback after the FOMC assembly on Wednesday — within the least, Powell all however dominated out one other price hike this 12 months — small enterprise confidence within the Fed has declined. Final quarter, just a little over one-third (35%) of enterprise house owners stated that they had confidence within the Fed. That is not fallen again to 31%, the place it was in Q2 of final 12 months.

“Inflation stays a prime concern, clearly, for small companies,” stated U.S. Small Enterprise Administration head Isabel Casillas Guzman in an interview with CNBC’s Kate Rogers on the digital Small Enterprise Playbook occasion on Thursday. “We have tried to ensure the SBA is extra available to credit score worthy debtors on the market. Half of companies do not get the capital they want totally, or in any respect.”

She prompt small enterprise house owners begin with native SBA useful resource companions, native district places of work, which may join them with lenders on the bottom, in addition to beginning with the SBA’s on-line Lender Match instrument.

One discovering over which small companies are in step with a broader macro view is the general state of the financial system. Over one-quarter (27%) describe the financial system as “glorious or good,” which has not trended decrease whilst inflation fears have picked again up. It is also notably up from 21% within the year-ago quarterly survey. The financial system’s efficiency helps clarify why practically thrice as many enterprise house owners cite inflation as the largest threat they face (37%) in comparison with the No. 2 risk, client demand, at 13%.

SBA Administrator Guzman cited the 17.2 million new enterprise purposes filed through the Biden administration as an indication of the financial optimism regardless of inflation. She pointed to the Biden laws that’s spurring authorities spending on infrastructure and clear vitality, that are financial development drivers. “These are all small enterprise trades throughout these alternatives,” she stated. “That is the financial development the president has been targeted on.”

More and more, although, it is also a fiscal policy-linked spending plan and rise in federal debt that economists are tying to sticky inflation.

The CNBC|SurveyMonkey Small Enterprise Confidence Index was unmoved quarter-over-quarter, at 47 out of 100, and up one level from Q2 of final 12 months.

The CNBC|SurveyMonkey information is in keeping with different current small enterprise survey findings. Goldman Sachs’ 10,000 Small Companies Voices survey launched this week cited 71% of small enterprise house owners saying inflationary pressures have elevated on their companies over the previous three months and 49% saying they’ve needed to increase the costs. Within the CNBC survey, 48% stated they’re elevating costs.

Inflation will loom giant in how America’s small enterprise house owners tilt within the presidential election.

Inflation is the No. 1 situation over which small enterprise house owners say they are going to vote, with 63% of survey respondents citing it, adopted by financial development at 61%.

Confidence in President Biden’s dealing with of the presidency — which is often low in a small enterprise demographic that skews conservative — stays underwater within the new survey, at 31%, down by two share factors quarter over quarter. Amongst Republican small enterprise house owners taking the survey, 5% approve of the job Biden is doing. Amongst Democrats, 82% of small companies approve of Biden, although pollsters say that approval scores below 90% inside one’s personal social gathering are a sign of dissatisfaction.

Biden has made some positive factors along with his supporters, with the general Small Enterprise Confidence Index studying amongst this survey subset unchanged quarter over quarter at 61, and up from 55 in Q3 of 2023.

The CNBC survey discovered that in a single space, small enterprise house owners who determine as both Republicans or Democrats do attain a uncommon level of consensus: each say that in terms of authorities coverage, they’re getting slighted in comparison with giant companies.

The Goldman Sachs survey discovered that 55% of enterprise house owners are sad with the quantity of focus small enterprise points get from candidates. Inflation, at 73%, was the difficulty cited most steadily.

Guzman stated that the SBA has doubled the variety of small-dollar loans, together with to startups, in addition to to ladies and folks of shade, who she famous are beginning companies on the highest charges. She additionally stated extra of the federal government mortgage quantity goes into “rural banking deserts.”

And the entire quantity of presidency contracts going to small companies has reached 28%, Guzman stated, roughly $178 billion, in accordance with the current authorities scorecard. “We would like extra individuals to do enterprise with the most important purchaser on the earth,” she stated.

Related posts

Subscribe

* You will receive the latest news and updates!

Quick Cook!

Is it Unlawful to Demand a Return to Workplace?

The patterns of distant and versatile working that adopted the COVID-19 pandemic and lockdown restrictions are starting to waver, with…

The Startup Journal The way to Safe Short-term Startup Funding If You Don’t Have Traders But

Beginning a brand new enterprise is an thrilling journey, but it surely usually requires a big sum of money to…