Pixelcatchers | E+ | Getty Photos

It isn’t a simple time to be a small enterprise in quest of financing. For LGBTQ house owners, the wrestle has been even tougher.

LGBTQ-owned companies reported extra rejections than non-LGBTQ companies that utilized for funding, based on a 2022 report from Motion Development Challenge, a nonprofit assume tank that focuses on equality and alternative, and the Middle for LGBTQ Financial Development & Analysis (CLEAR).

With the tightening of lending requirements, they might be at much more threat of falling behind, stated Spencer Watson, president and govt director of CLEAR.

“The tighter financial circumstances, the upper rates of interest, the collapse of those smaller group banks and the ensuing constriction of lending is actually extra detrimental for the LGBTQ group than non-LGBTQ group,” Watson stated.

Issues in regards to the financial system and lending circumstances aren’t solely on the minds of LGTBQ entrepreneurs. Total, small enterprise house owners are skeptical about their future enterprise circumstances, stated Holly Wade, govt director of the Nationwide Federation of Unbiased Enterprise’ Analysis Middle.

“The small enterprise financial system is being hindered by inflation, provide chain disruptions, and labor shortages,” she stated. “Whereas financing is not a prime downside for small companies, house owners have expressed considerations in regards to the well being of the banking system for his or her enterprise functions in mild of the banking turbulence in March.”

But, information present that relating to financing, LGTBQ small enterprise house owners are being left behind. In 2021, 46% of LGBTQ-owned companies stated they did not obtain any of the financing they’d utilized to in 2021, based on the MAP/CLEAR report. As compared, 35% of non-LGBTQ companies that utilized for funding had been rejected, the report discovered. A lot of the funding sought was by way of the Covid aid applications supplied, Watson stated.

“These companies had been ceaselessly smaller in dimension they usually had been additionally ceaselessly youthful they usually had smaller revenues,” Watson defined. “They had been combating these extra pressures as a result of they had been already in a weaker monetary place to start out with.”

Watson stated there are related themes rising within the evaluation of the 2022 Federal Reserve’s small enterprise credit score survey, which hasn’t been absolutely launched but.

Whereas LGBTQ small enterprise house owners are very optimistic, they’re additionally nonetheless extra prone to report extra varieties of monetary challenges than non-LGBTQ companies. Some six in 10 reported difficulties affording working bills over the past 12 months, based on Watson, who prefers a gender-neutral pronoun. Many of the companies are owned by individuals who establish as LGBTQ however their companies aren’t essentially oriented in direction of or servicing the LGBTQ group, they stated.

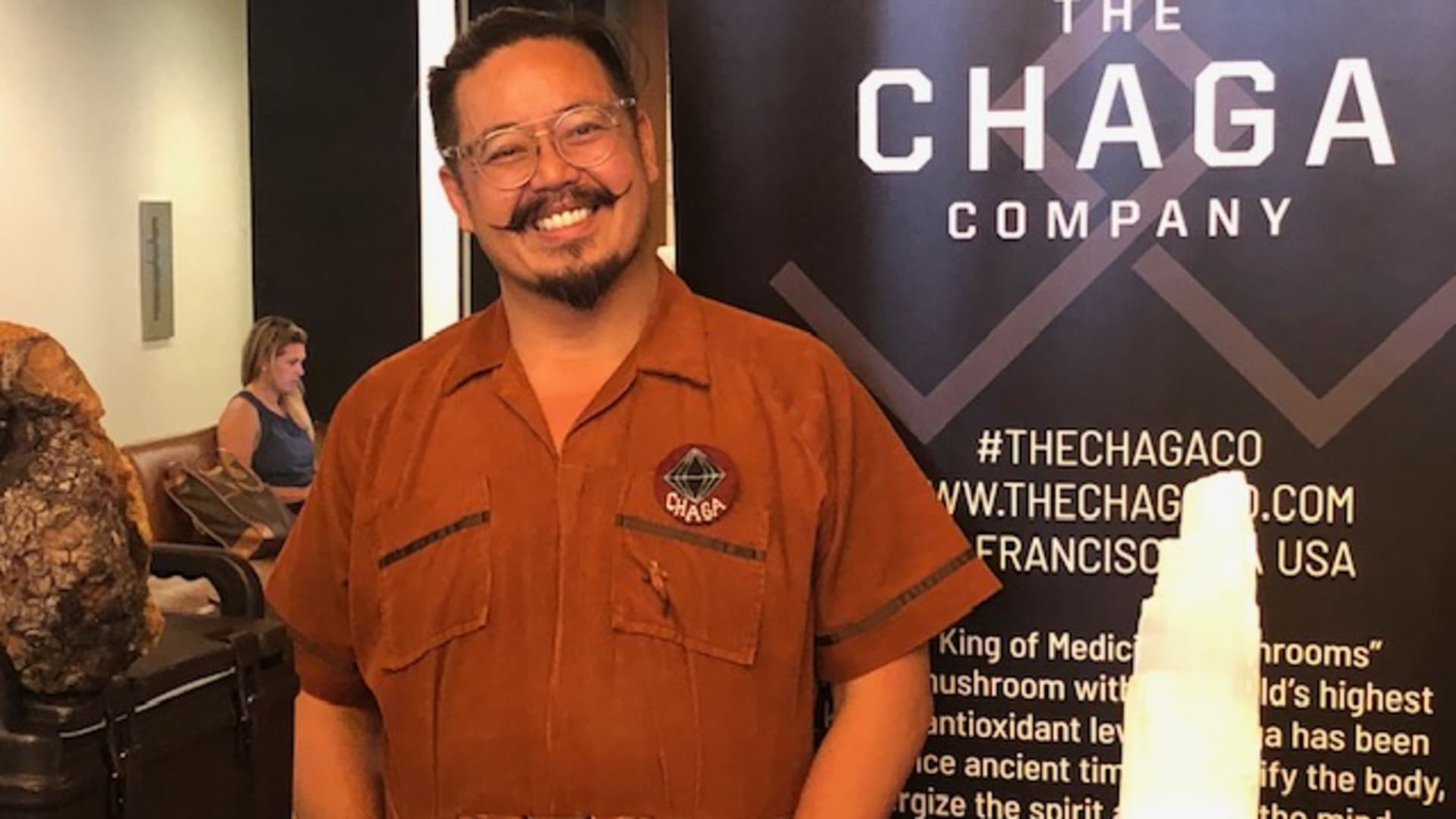

Gavin Escolar

Courtesy: Gavin Escolar

Gavin Escolar, proprietor of The Chaga Firm in San Francisco, is a type of small enterprise house owners that has had troubling discovering financing. The 47-year-old homosexual man began his enterprise, which makes merchandise from chaga mushrooms, in 2018 by utilizing his financial savings and bank cards. Whereas he hasn’t been rejected for any loans he is utilized for, he has been solely supplied high-interest bridge loans from lenders to carry him over till a lower-interest small enterprise mortgage turns into accessible, he stated.

“They’re like, ‘oh yeah, you are just about authorized for this specific SBA mortgage, however it should take like round six months so that you can get it. However now we have this different mortgage you could bridge proper now, that’s 29.75%,’ or no matter exuberant value,” Escolar stated.

Proper now he is utilizing loans from Sq. and PayPal and is hoping to determine his subsequent step in order that he will pay down his bank card debt, purchase stock and do advertising and marketing. Escolar feels just like the group wants extra schooling on how you can get the correct financing.

“I am solely getting the upper [interest loans] as a result of I really feel like I haven’t got established enterprise credit score,” Escolar stated. “I am fluctuating between my enterprise credit score and my private credit score. I do not even know the place to start out on how you can construct a enterprise credit score.”

Forging her personal path

Sarah Scala

Supply: Sarah Scala

For 43-year-old Sarah Scala, going into debt wasn’t an choice when she began her enterprise, Sarah Scala Consulting. The Massachusetts firm is an LGBT-certified enterprise enterprise that gives management growth, public talking and management teaching.

Scala needed to remain debt free, so she used her personal financial savings and appeared for alternatives elsewhere. Apart from a Paycheck Safety Program mortgage throughout the Covid-19 pandemic, her solely different exterior supply of funding has been two grants from the Massachusetts Development Capital Company. These grants have helped her with digital advertising and marketing and capital bills.

“There’s quite a few great associations which might be actually useful if individuals are in search of assist round funding,” stated Scala, who operates the enterprise out of her residence.

One is SCORE, a community of volunteer enterprise mentors, which Scala is concerned with. She additionally has a powerful partnership with the Massachusetts LGBT Chamber of Commerce, which may help open doorways, she stated.

Discrimination at play

Anti-LGBTQ bias and discrimination towards LGBTQ small-businesses can come up throughout the mortgage course of in quite a few locations, Watson stated.

“If the lender discerns the candidates’ LGBTQ identification, they could select to disclaim that mortgage or cost the applicant the next value for the credit score they’re authorized for,” they defined. “That is notably the case for extremely seen members of the LGBTQ group — corresponding to transgender or nonconforming gender displays.”

It could additionally present up in different methods, like if a creditor does not perceive the enterprise’s market alternative, like not seeing the profit or market want for an LGBTQ-serving institution, Watson stated.

Companies oriented explicitly towards people of sexual minorities and that create sex-positive areas are additionally ceaselessly excused as a result of Small Enterprise Administration tips forbid loans for companies of a “prurient sexual nature,” they stated.

Nevertheless, Watson cheered the current rule from the Shopper Monetary Safety Bureau that will increase transparency in small enterprise lending and contains demographic info, permitting small companies to establish as women-, minority-, or LGBTQ-owned.

“Implementing that information assortment could be an unbelievable boon to combating discrimination within the personal lending marketplace for small companies,” they stated.

The success of those companies matter — not just for the house owners however for the group at giant, Watson stated.

“There’s a want for extra small companies owned by all sorts of marginalized communities in order that these entrepreneurs can assist themselves, their fellow group members, and create extra inclusive areas which might be authentically by and for these communities,” they stated.

Related posts

Subscribe

* You will receive the latest news and updates!

Quick Cook!

Is it Unlawful to Demand a Return to Workplace?

The patterns of distant and versatile working that adopted the COVID-19 pandemic and lockdown restrictions are starting to waver, with…

The Startup Journal The way to Safe Short-term Startup Funding If You Don’t Have Traders But

Beginning a brand new enterprise is an thrilling journey, but it surely usually requires a big sum of money to…