The chancellor is reportedly assembling a help bundle geared toward entrepreneurs and small companies forward of November’s Autumn Price range.

The bundle is anticipated to incorporate growth of the Enterprise Administration Incentive (EMI) scheme, and different investment-friendly tax incentives.

It’s a welcome bit of reports that indicators the federal government could prioritise progress and innovation for startups within the upcoming assertion. SMEs have been ready anxiously for updates because the date approaches.

What the federal government is planning for startups

Final week, Sky Information reported that the federal government has proposed to boost the cap on EMIs forward of the Autumn Price range, which is about to happen on November 26.

The EMI scheme is a tax-friendly plan which permits startups to promote shares to staff. It could inspire groups to really feel really a part of a startup’s mission, whereas additionally providing engaging tax advantages.

Presently, the cap is about at £250,000 over a three-year interval, and applies to companies with property of £30m or much less, and fewer than 250 staff.

The proposed EMI reform would enhance the £250,000 cap to permit scaling corporations extra flexibility to promote shares. It might additionally simplify guidelines round eligibility and a few admin necessities which could at the moment put some startups off.

The reform would additionally make EMI extra accessible to a wider vary of companies, not simply early-stage tech corporations.

How are enterprise leaders reacting?

Concerning the proposal, Louise Jenkins, Managing Director at Alvarez & Marsal Tax, praised it as a optimistic signal the federal government is prioritising SMEs.

“The proposed growth of the Enterprise Administration Incentive scheme is a welcome sign that the federal government needs to champion small and medium-sized enterprises.

Extending the EMI cap would give rising companies higher flexibility to draw and retain expertise at a time when wage pressures and better borrowing prices are already squeezing margins.

“If the federal government’s intention is to foster a extra entrepreneurial economic system, the main target needs to be on simplification as a lot as generosity; many small companies nonetheless discover current EMI guidelines complicated and administratively burdensome.”

That stated, the run as much as the funds thus far has been much less optimistic for small companies. It’s been a troublesome yr for SMEs following tax rises and employer Nationwide Insurance coverage will increase.

And regardless of guarantees for swift reforms, it stays unclear if earlier pledges to “repair” enterprise charges by the Labour celebration can be adopted by way of with on November 26th.

Why this issues for startup founders

A stronger EMI scheme and broader tax reliefs have the potential to make hiring, retaining, and motivating high expertise that a lot simpler for startup founders. This presents a vital benefit in a troublesome funding atmosphere.

With enterprise capital nonetheless tight and borrowing prices excessive, incentives that ease the stress on money circulate are as priceless as ever.

Founders ought to control the Autumn Price range within the subsequent few weeks, and be able to evaluation their current EMI constructions with an accountant or tax advisor if particulars are confirmed. Even small tweaks to share schemes could make a giant distinction in attracting and retaining the correct individuals.

However whereas reforming the EMI scheme can be a great addition for founders, it’s removed from essentially the most pressing concern on the desk. UK companies can be on the lookout for deeper, extra instant measures within the funds to ease prices and unlock actual progress.

Related posts

Subscribe

* You will receive the latest news and updates!

Quick Cook!

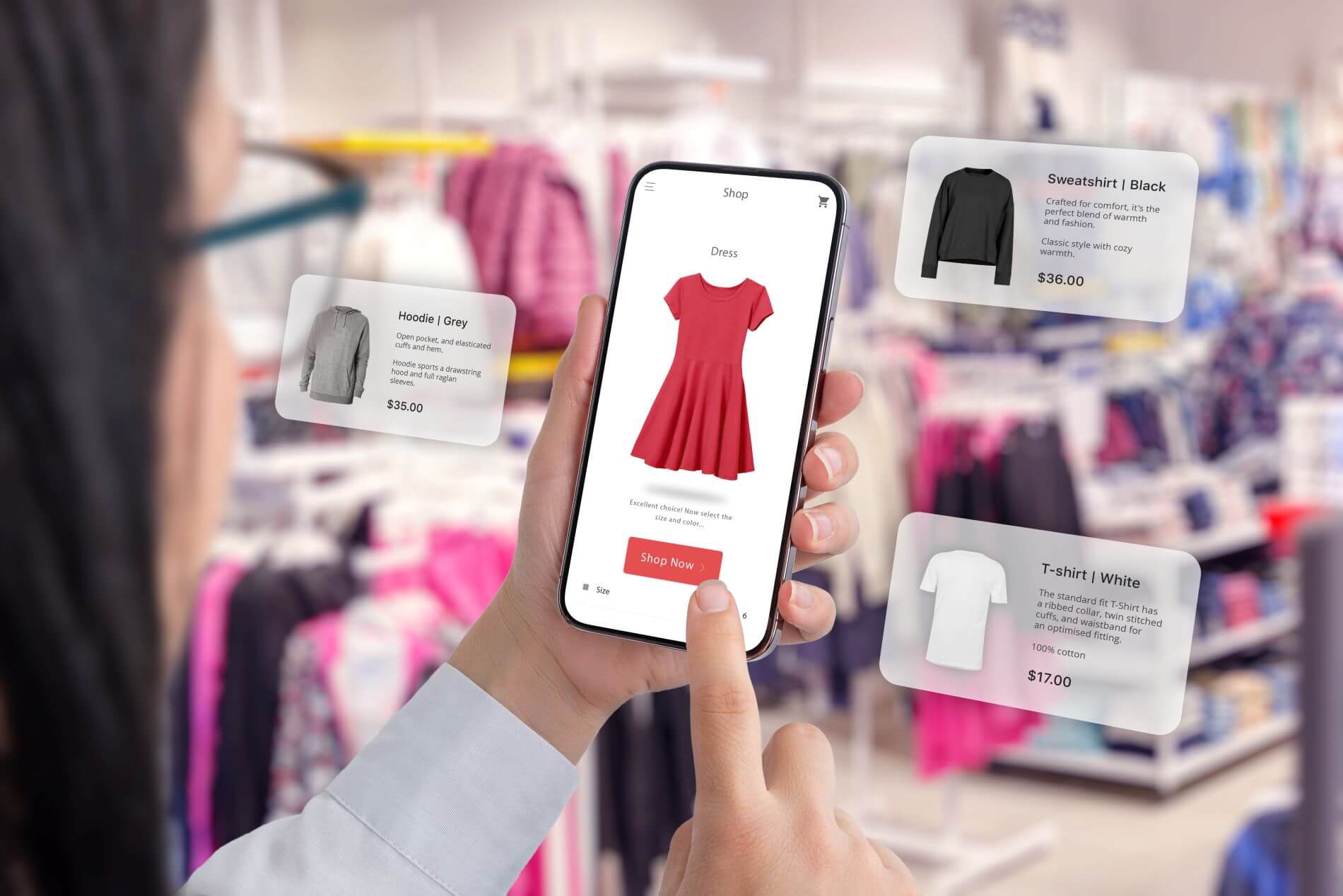

AI Might Trigger Ecommerce “Enshittification”, Warns Knowledgeable

It isn’t information to anybody that the web isn’t what it was. These days, lots of the on-line areas we…

UK Excessive Avenue Predicted To Face £1bn Enterprise Charges Rise

One other week and one other warning that SMEs and startups may very well be cripped by a enterprise charge…